1500 paycheck after taxes

Computer software up to 350 and personal computers up to 1500. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Itemized Taxes Paid Itemized.

. Apply now and find out why 95 of Speedy Cash Customers are satisfied. If you make 20000 utilities should be around 2000 a year. Check to claim a spouse deduction.

See current prices here. Federal government websites often end in gov or mil. Your goal in this process is to get from the gross pay amount gross pay is the actual amount you owe the employee to net pay the amount of the employees paycheck.

So if you make 15000 a year utilities should cost you around 1500 a year. The amount you pay in taxes depends on many different factors. Check if single or married and family has only one job or a second job has annual income of less than 1500.

SmartAssets Georgia paycheck calculator shows your hourly and salary income after federal state and local taxes. After all just getting a good-paying job can sometimes feel like a bonus in and of itself. The rate at which federal taxes are withheld from your paycheck depends on the information you provide on your Form W-4.

The other sales tax holiday is the Show-Me Green holiday. A dependent is an individual whom a taxpayer can claim for credits andor exemptions. Less than the previous example.

For people with alternating work schedules like doctors or nurses to calculate their average hours they would add 2 weeks together then divide by 2. After you have calculated gross pay for the pay period you must then deduct or withhold amounts for federal income tax withholding FICA Social SecurityMedicare tax state. College to pay 37M to local bakery after students alleged racism In a 2016 lawsuit the Ohio small business had accused the school of falsely accusing it of racial discrimination.

In February he receives salary of 1000 plus a commission of 500 which you combine with regular wages and dont separately identify. Each year youll want to calculate your expenses both ways and then choose the method that yields the larger. Using Worksheet 3 and the withholding tables in section 3 of Pub.

For example 3000 in self-employment tax reduces your taxable income by 1500. Free Federal and Minnesota Paycheck Withholding Calculator. Hourly Paycheck Calculator Enter up to six different hourly rates.

The Actual Expenses method or 2. The larger the paycheck. This plan also has an individual deductible of 1500 for each family member.

Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 1500 after taxes. Pays for itself TurboTax Self-Employed. Taxes can really put a dent in your paycheck.

When youre in the middle of a job search it can feel confusing to hear about sign-on bonuses. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. The table below shows state and county sales taxes in every county in Georgia.

Utility expense can vary depending on usage so if you are very frugal with power gas water and internet you. Salary Paycheck Calculator How much are your wages after taxes. Before sharing sensitive information make sure youre on a federal government site.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Likewise 36 plus 48 is 84 hours which becomes 42 after dividing by 2. The annual deductible for the family plan is 3500.

The plan doesnt qualify as an HDHP because the deductible for an individual family member is less than the minimum annual deductible 2800 for family coverage. Number of dependents other than you and spouse you claim. Miami PD officer behind bars after allegedly attempting to drive patrol car under the influence Jeffrey Marcano has been suspended without pay pending an investigation.

For amounts incurred or paid after 2017 the 50. The correct withholding from the tables is 78. Income After Taxes.

The deduction under the optional method is limited to 1500 per year based on 5 per square foot for up to 300 square feet. But youll still make 31899 the next year whereas youll only make 28205 after taxes in your second year if. Each method has its advantages and disadvantages and they often produce vastly different results.

If you make 50 an hour you would take home 78000 a year after taxes. 25 an hour is 2000 biweekly before taxes and approximately 1500 after taxes. The gov means its official.

If you make 20000 after taxes you should pay 580 a month on rent. But with a Savings or CD account you can let your money work for you. It applies to certain Energy.

You have family health insurance coverage in 2021. 2022 W-4 Help for Sections 2 3 and 4. In the 22 tax bracket that would mean an income tax savings of 330.

But after paying 25 in taxes your after-tax salary would be 78000 a year. Hottest Cam Girls Best Value-For-Money The following is a list of the best cam sites in 2022 from the viewers audience members perspective based on hottest cam girls and best. Your pre-tax salary was 104000.

50 an Hour is How Much a Year After Taxes. Gross income or gross pay is an individuals total pay before accounting for taxes or other deductions. 15-T you withhold 29 from this amount.

Working 10 hours a. So for example 3 days plus 4 days is 7 days which divided by 2 is 35 days in their average work week. If filed after March 31 2022 you will be charged the then-current list price for TurboTax Live Basic and state tax filing requires an additional fee.

While Georgia has one of the lowest statewide sales taxes in the country among states that have a sales tax Atlanta has its own city sales tax of 115 and counties can assess their own sales taxes of up to 49. A dependent is an individual such as a qualifying child whom a taxpayer can claim on his or her. At the company level its the companys revenue minus the cost of good sold.

You dont owe taxes on side hustles. You figure the withholding based on the total of 1500. How to calculate taxes taken out of a paycheck.

For Guys Viewers - Best Cam Sites To Watch For Cam Girls Models - Highest Paying Cam Sites Frequently Asked Questions Best Cam Sites for Live Sex Chat in 2022. But assuming a 25 to 30 tax rate is reasonable. Enter your info to see your take home pay.

The IRS offers two ways of calculating the cost of using your vehicle in your business. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. This is an estimated quarterly taxes myth because the IRS requires you to pay taxes on all sources of income unless theyre specifically excluded.

For example say you only decided to work a couple of shifts and ended up working a total of 10 hours in a week. Under this method you claim your allowable mortgage interest real estate taxes and casualty losses on the home as itemized deductions on Schedule A Form 1040.

Avanti Gross Salary Calculator

Realtor Income Etsy Canada

How To Calculate Net Pay Step By Step Example

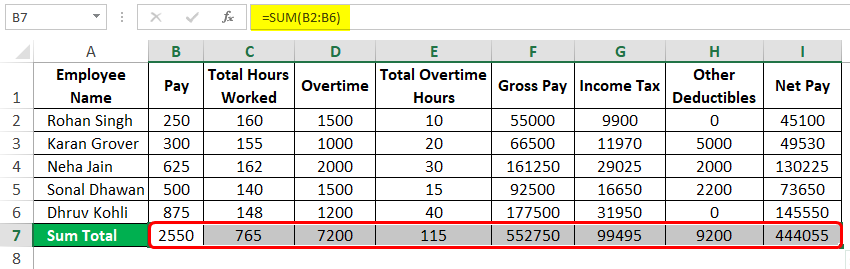

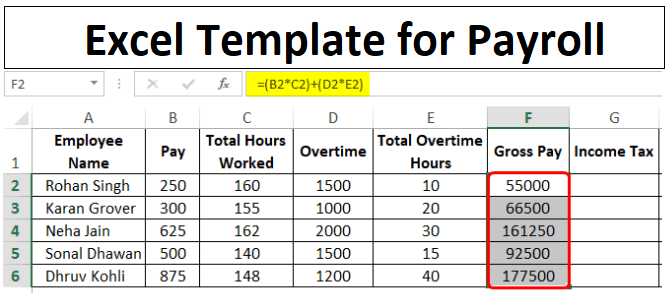

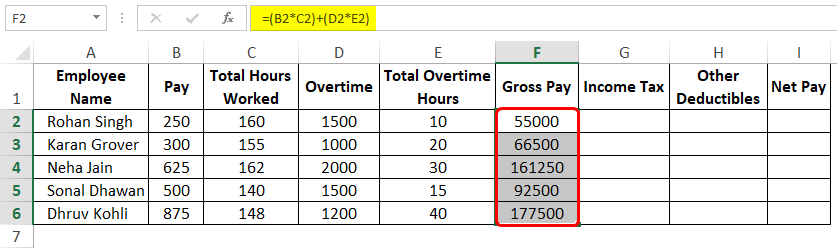

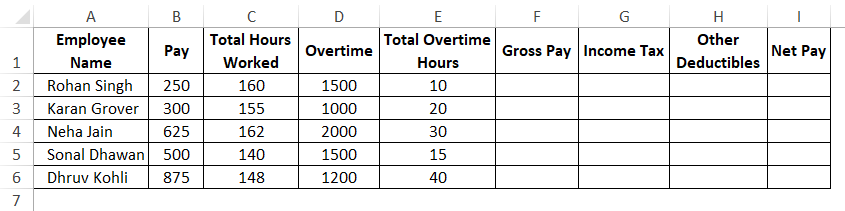

Excel Template For Payroll How To Create Payroll Template In Excel

9 Simple Budget Categories To Easily Manage Your Money In 2022

1 500 After Tax Us Breakdown August 2022 Incomeaftertax Com

Excel Template For Payroll How To Create Payroll Template In Excel

Linguistics Career Guide What You Can Do With A Linguistics Degree Bachelor Of Arts In Linguistics The Study Of Linguistics Word Origins Writing Prompts

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Excel Template For Payroll How To Create Payroll Template In Excel

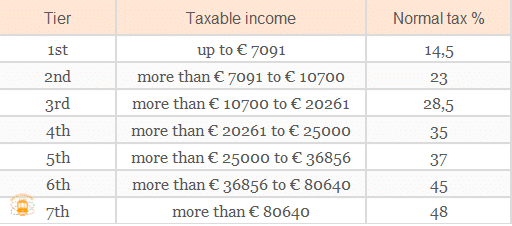

Taxes In Portugal Discover Everything You Need To Know Go To Portugal

3 Form For 3 3 Precautions You Must Take Before Attending 3 Form For 3 W2 Forms Template Printable Printable Job Applications

Ql5kv20i14afzm

K33w4ljb410vgm

Price Quotation Templates 10 Free Docs Xlsx Pdf Quotations Quotation Sample Excel Templates

Mundo Quatro Rodas Autonews Cvs Health Tests Self Driving Vehicle P Pizza Company Autonomous Vehicle New Technology

Excel Template For Payroll How To Create Payroll Template In Excel